UKMTO Issues Warning to Shipping Industry over Middle East Tensions

Various news sources on June 11 reported that the U.K. Maritime Trade Operations (UKMTO), a voluntary maritime safety information service, issued an advisory to the shipping industry regarding increased tensions […]

HTS Update Related to Aluminum and Steel Tariffs

President Trump’s June 3 proclamation increased aluminum and steel tariffs from 25% to 50 %, effective 12:01 a.m. ET on June 4,and included that the non-aluminum, non-steel content of all aluminum […]

GSM INTERNATIONAL: Follow-Up to May 28 CIT Opinion Invalidating IEEPA Tariffs

Sandler, Travis & Rosenberg, P.A. (ST&R) has provided this overview of the following actions that have taken place since the May 28 Court of International Trade (CIT) opinion validating the […]

50% Tariffs for Steel and Aluminum Imports Take Effect 12:01 a.m. ET June 4

“Dear Importers, Effective today, June 4, 2025, all imports of aluminum and steel, except from UK, will be imported at 50% under Sec 232. UK will have a grace period […]

CSMS # 65201773 – UPDATED GUIDANCE – International Emergency Economic Powers Act (IEEPA) Reciprocal In-Transit End Date Extension

“Dear Importers, CBP has revised the IEEPA reciprocal tariff exemption date from May 28, 2025 to June 16, 2025 if your cargo departed from POL before April 5, 2025 and […]

ST&R Trade Analysis: More About CIT Opinion Repealing Trump Administration IEEPA Tariffs

Dear Importers, Please see notice on increase to Sec 232 Steel and Aluminum tariffs from 25% to 50%, effective June 4. Will keep you posted. The following analysis was provided […]

ST&R Trade Analysis: More About CIT Opinion Repealing Trump Administration IEEPA Tariffs

“Dear Importers, On May 28, 2025, CIT ruled the IEEPA tariffs unlawful on both the fentanyl and reciprocal tariffs. The government has 60 days to file an appeal in which […]

Recent CBP De Minimis FAQ Updates of Interest

Question: If goods are made in China and shipped to another country (i.e. Mexico, Canada, Japan, etc.) for entry to the U.S., can it qualify for de minimis treatment once it […]

Recent CBP Section 232 Steel and Aluminum Tariff FAQ Updates of Interest

Question: Can 9903.01.33 be claimed if the imported article is classified under a Section 232 new derivative tariff number but contains no steel or aluminum and is therefore not subject to […]

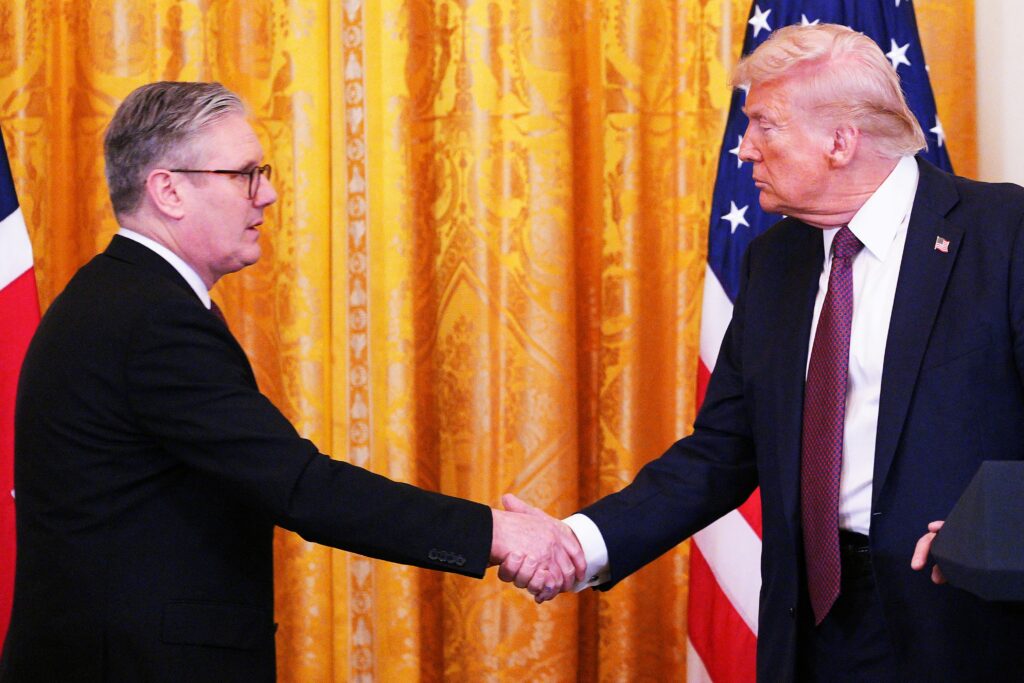

Trump Administration Reaches Trade Deal with U.K.

The White House today announced a trade deal has been reached with the U.K. While the reciprocal tariff rate of 10% remains in effect for most imports from the U.K., […]